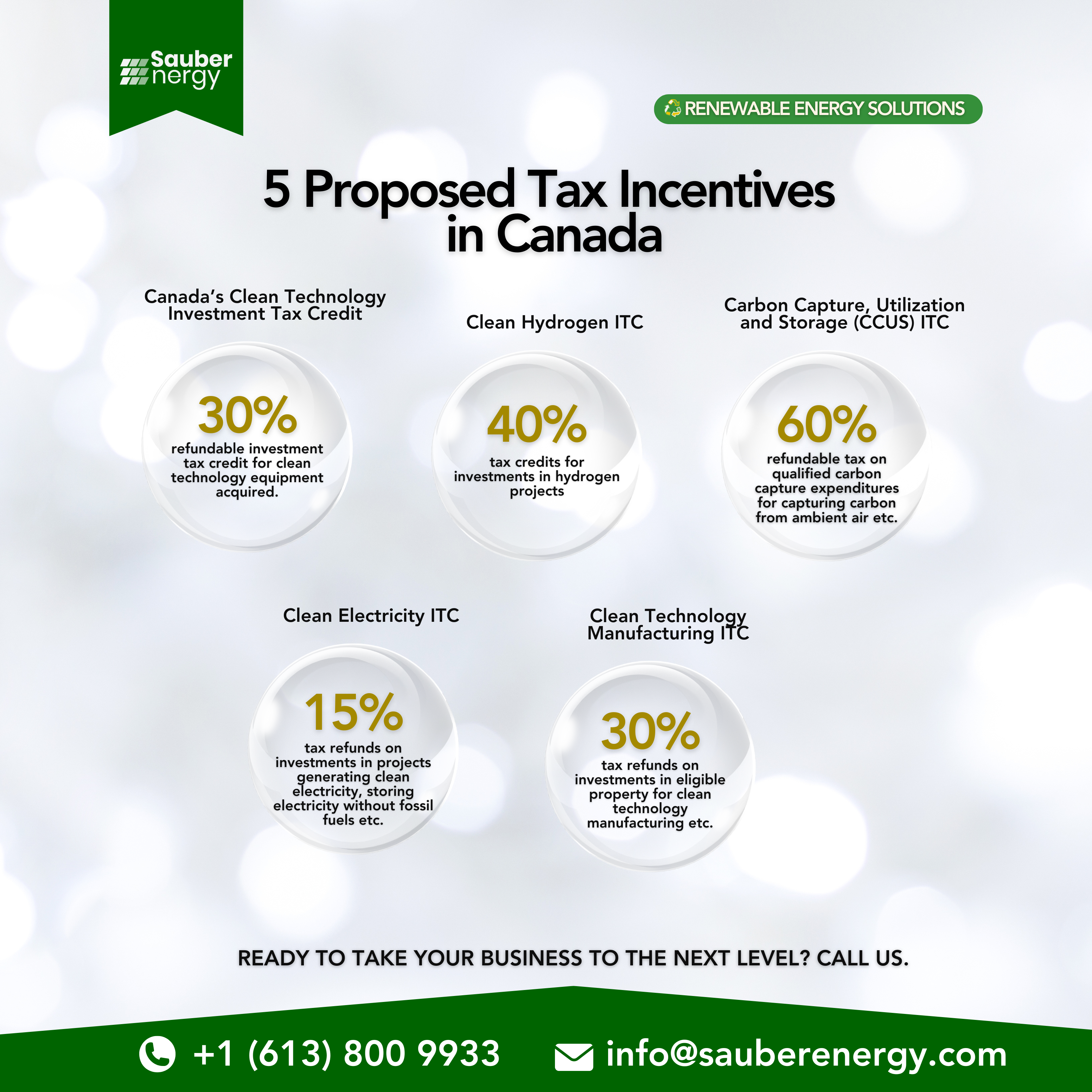

Recently, the Canadian government proposed five new refundable investment tax credits (ITCs) to boost the country’s clean economy and attract investment in clean energy projects. This is in response to a growing emphasis on transitioning to renewable energy sources to combat climate change and reduce our carbon footprint.

These tax credits present an opportunity for homeowners and businesses to invest in renewable energy solutions while benefiting from tax incentives, thereby reducing costs and potentially increasing profits.

These are refundable tax credits. That is, these tax credits would be treated as amounts that have been paid by the taxpayer on account of tax, and if no more tax is payable for the year, the taxpayer would receive a refund.

Taxpayers would generally be able to claim only one of these tax credits in respect of the acquisition of an eligible property, even if the particular property would be eligible for more than one of these tax credits.

- Clean Technology ITC: A refundable tax credit of up to 30% for investments in eligible property acquired and ready for use between March 28, 2023, and before 2034. The tax credit reduces to 15% for property ready for use in 2034, and no credit is available for property ready after 2034.

- Carbon Capture, Utilization and Storage (CCUS) ITC: A refundable tax credit for expenditures between January 1, 2022, and December 31, 2030. The credit covers up to 60% of qualified carbon capture expenditures for capturing carbon from ambient air, up to 50% for capturing carbon from other sources, and up to 37.5% for transportation, storage, and use expenditures. The credit reduces by half from 2031 to 2040 and is not available after 2040.

- Clean Hydrogen ITC: A refundable tax credit of up to 40% for investments in hydrogen projects ready for use between March 28, 2023, and before 2034. The credit reduces by half for projects ready in 2034 and is not available for projects ready after 2034.

- Clean Electricity ITC: A refundable tax credit of up to 15% for investments in projects generating clean electricity, storing electricity without fossil fuels, or transmitting electricity between provinces and territories. The credit is available for projects starting construction after the 2024 federal budget is delivered and is not available after 2034.

- Clean Technology Manufacturing ITC: A refundable tax credit of 30% for investments in eligible property for clean technology manufacturing and critical mineral extraction and processing. The credit is available for property acquired and ready for use between 2024 and 2031, with decreasing rates for subsequent years.

(Please note that as at the time of this report, none of these tax credits have yet been passed into law.)

Consider Solar Energy for your Home or Business

The proposed tax incentives for clean energy in Canada present a promising opportunity for individuals and businesses to contribute to a sustainable future while benefiting financially. By investing in solar panel installation and maintenance services, you can not only take advantage of these tax incentives but also make a meaningful impact on the environment.

At Sauber Energy, our solar panel installation and maintenance services are designed to help you maximize these tax benefits while ensuring the efficient and reliable operation of your solar energy system. Contact us today to learn more about how we can help you harness the power of solar energy and enjoy the benefits of these tax incentives. Together, we can create a cleaner, greener future for generations to come.